The influence of the U.S. Federal Reserve (Fed) rates and U.S. Treasury bonds on interest rates in Latin American countries is a complex and multifaceted phenomenon of paramount importance in our globalized world. This intricate relationship impacts capital flows, financing costs, currency value, and local monetary policies, thereby significantly affecting the economic and financial stability of these markets.

The correlation between these rates can be influenced simultaneously by various exogenous factors, such as the economic cycle and global risk appetite, and endogenous factors, including each country’s monetary policy, exchange rate regime, level of dollarization, and foreign investment in local markets. U.S. government rates represent an opportunity cost of investing in higher-risk assets, adding a layer of complexity. In a globalized market, macroeconomic variables are interconnected, making the relationship between interest rates in different currencies neither direct nor predictable. Interest rate differentials also affect currency relationships, namely exchange rates. Currencies with increased interest rates, ceteris paribus, will see increased capital inflows and, thus, an appreciation in their currency value.

Central banks play a pivotal role in monitoring these relationships and designing and adjusting their monetary policy measures. For Latin American central banks, in particular, this vigilance and the capital flows it triggers enable them to fine-tune other variables, such as exchange rate intervention mechanisms and local liquidity instruments.

Grasping the correlation between U.S. Treasury rates and local rates in Latin America, and how it influences other macro variables, is not just important, it’s crucial for both global macro investors and multinational corporations. This understanding allows for more informed investment and diversification strategy decisions, and it directly impacts the financial stability and risk management strategies of international corporations with balance sheet accounts in different currencies.

Opportunity Cost

U.S. Treasury bonds are considered risk-free assets and represent the opportunity cost of investing in higher-risk assets. This cost becomes more relevant when Fed rates are at higher levels. When U.S. Treasury rates increase substantially, investors demand higher returns from riskier assets as the opportunity cost of investing in risky assets becomes more significant. The higher the U.S. Treasury rates, the more sensitive Latin American and emerging market interest rates will be to U.S. Treasury rate movements.

Similarly, lower Fed rates allow Latin American Central Banks more flexibility to adjust their local rates. A higher differential between U.S. Treasury rates and local rates increases the attractiveness of investing in local rates, influencing investment decisions and global capital flows.

Simultaneously, the capital flows that this dynamic triggers affect the value of local currencies and the level of exchange rates. Latin American Central Banks often intervene in the foreign exchange market to avoid volatility and fluctuations in the local currency value. For example, the Central Bank may intervene in response to depreciatory pressures on the local currency to prevent excessive depreciation that could lead to exchange rate pass-through effects on inflation levels. However, the ability of Central Banks to implement these policies depends on the Net International Reserves (NIR) level, as higher reserves provide greater capacity and credibility for local central banks to intervene in the local foreign exchange market.

Global Risk Appetite

Global risk appetite plays a crucial role in this relationship. When global investor sentiment turns risk-averse, a perceived increase in global market risk leads to capital inflows toward risk-free assets, such as U.S. Treasury bonds. The increased demand for U.S. Treasury notes results in a decrease in U.S. Treasury yields. Simultaneously, in this scenario, we observe outflows from assets considered riskier or “high beta”, such as bonds from emerging and Latin American countries, putting upward pressure on their interest rates. The capital flow resulting from this risk-off scenario leads to a temporary inverse relationship between U.S. Treasury rates and local rates of Latin American countries, widening the differential between the two interest rates.

At the peak of the COVID-19 pandemic, the market experienced a decrease in risk appetite, and we saw how this affected global rates. Amid economic uncertainty and volatility in global financial markets, U.S. Treasury rates fell significantly, acting as a safe haven asset for investors. Concurrently, we observed outflows from emerging market bonds, putting upward pressure on their rates. These flows led to a negative correlation between U.S. Treasury rates and rates in Latin American countries.

According to the IMF article “The COVID-19 Crisis and Capital Flows,” in March 2020, as COVID-19 cases rapidly increased and financial markets plummeted, non-resident investors sold a record $83 billion in emerging market stocks and bonds, seeking less risky investments.1

Economic Cycle

The phase of the economic cycle also has implications for the relationship between U.S. Treasury rates and rates in emerging and Latin American countries. During periods of global economic expansion, this correlation tends to be positive. During economic booms, the U.S. Federal Reserve tends to raise its benchmark rate to prevent overheating of the economy and encourage healthy growth by avoiding inflationary pressures. Similarly, emerging and Latin American countries adjust their monetary policy to prevent inflationary pressures driven by improved economic activity. Additionally, if the Fed increases its benchmark rate and central banks in Latin America do not adjust their monetary policy in tandem, it would trigger capital flows and depreciatory pressures on the local currencies in Latin America.

On the other hand, during periods of economic contraction, this relationship becomes more complex and less direct. The increased uncertainty during global recessions boosts demand for risk-free assets such as U.S. Treasury bonds, while riskier emerging market debt experiences outflows – the risk-off flows discussed earlier. Risk aversion is higher in these global recession periods, and these risk-off flows are more prevalent. This correlation tends to be negative in a low-risk appetite environment, and the risk premium assigned to emerging assets (spread) increases.

However, there are also forces that make this correlation positive in this context of global economic contraction. During these periods, central banks in Latin American countries, like the Fed, will also be incentivized to adopt expansionary monetary policies and reduce their local currency interest rates to stimulate their economies and counteract the effects of the global recession on the local economy.

In the book “Trading Fixed Income and F.X. in Emerging Markets,” the authors conducted a regression of various emerging market assets on global macro variables, including the 10-year U.S. Treasury rate, for the period from 2002 to 2018. Unlike other categories of emerging market assets, such as stocks and currencies, only 36% of the variation in local interest rates is explained by movements in global macro variables. According to the authors, this intuitively makes sense, given the importance of local monetary policy in local interest rate levels.2

Implications for Investors and Corporations

Emerging markets’ sovereign debt in local currencies has grown rapidly in recent years, surpassing even the size of sovereign debt issued in dollars by these countries. Strong macroeconomic fundamentals in emerging markets, which have improved radically in recent decades, along with an increase in the number of domestic investors, have facilitated this trend.3 Additionally, foreign investor holdings of sovereign bonds in local currencies have increased rapidly. The demand for emerging market assets has institutionalized, and emerging market debt has become a popular asset type among foreign investors.

Emerging market debt offers high real rates, potential gains from local currency appreciation, and diversification benefits. Major investors in these assets include funds dedicated to emerging markets, central banks, sovereign wealth funds, hedge funds, and funds tracking indices with exposure to emerging markets. Hedge fund industry-managed funds invested in emerging markets have increased by 94% since 2013, currently totaling $429 billion.4

Global investors closely monitor macroeconomic variables and their correlations

Understanding the interactions between these variables is vital for constructing investment portfolios that maximize risk-adjusted returns, especially for macro investors who invest in currencies, bonds, rates, and commodities, as all these variables are correlated. Designing diversified portfolios when the correlations of these assets vary under different scenarios requires constant monitoring. Macroeconomic data such as inflation, economic activity, capital flows, and global risk sentiment, among others, are constantly evolving. Identifying and anticipating circumstances that will change the direction of these correlations is key for rebalancing investment portfolios and keeping the desired effects of diversification.

On the other hand, multinational companies are also affected by the movements in these macroeconomic variables. Global corporations have balance sheet accounts and operations in different currencies, and interest rate levels in dollars and in other currencies affect their financing costs and access to capital. Understanding the relationships between these macroeconomic variables is essential for financial planning decisions, such as capital structure, interest rate risk hedging, exchange risk, and the most efficient financing options considering the outlook on the exchange rate and interest rates in different currencies, and the costs of the derivatives that can be used to hedge open risks.

The Case of Peru

The level of inflation in Peru is currently controlled, and the Central Bank began its reference rate-cutting cycle in November 2023. Peru was one of the hardest-hit countries in Latin America during the pandemic, which, combined with the loss of confidence in the government and consequent decrease in investment levels, led to declines in potential output levels and economic activity deceleration.

In contrast, economic activity in the United States remained resilient thanks to expansive monetary and fiscal policy programs. These programs also sparked strong, persistent inflationary pressures, prompting the Fed to delay the start of an expansive monetary policy cycle. These divergences between both monetary policies have led to a significant contraction in the differential between U.S. Treasury rates and bonds in soles, reducing the attractiveness of investments in soles for global investors.

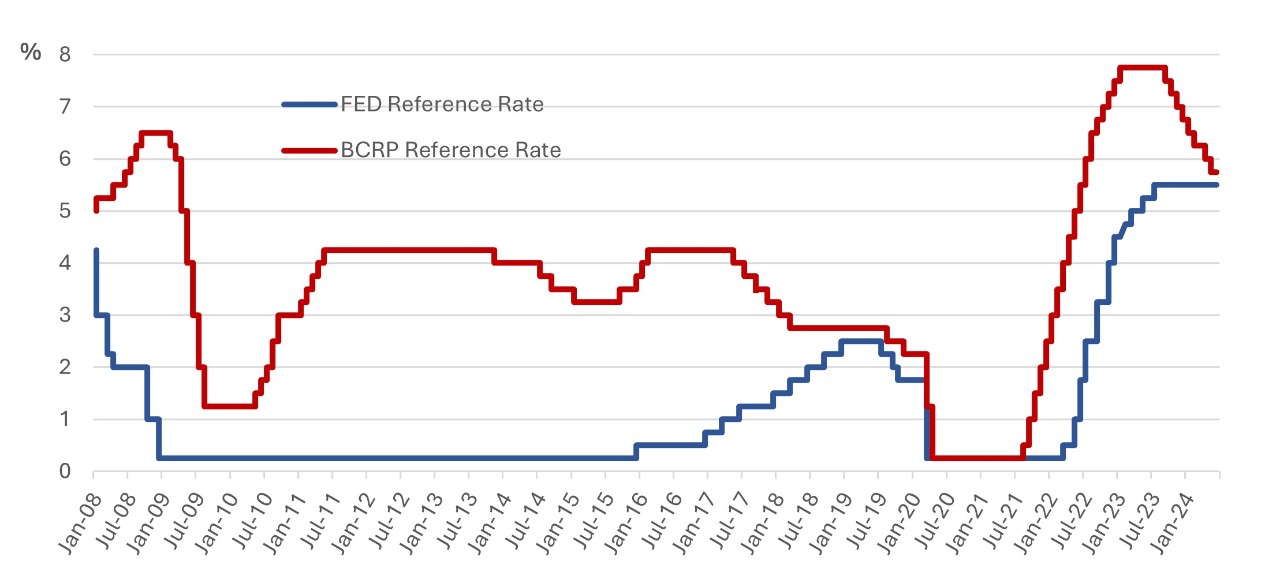

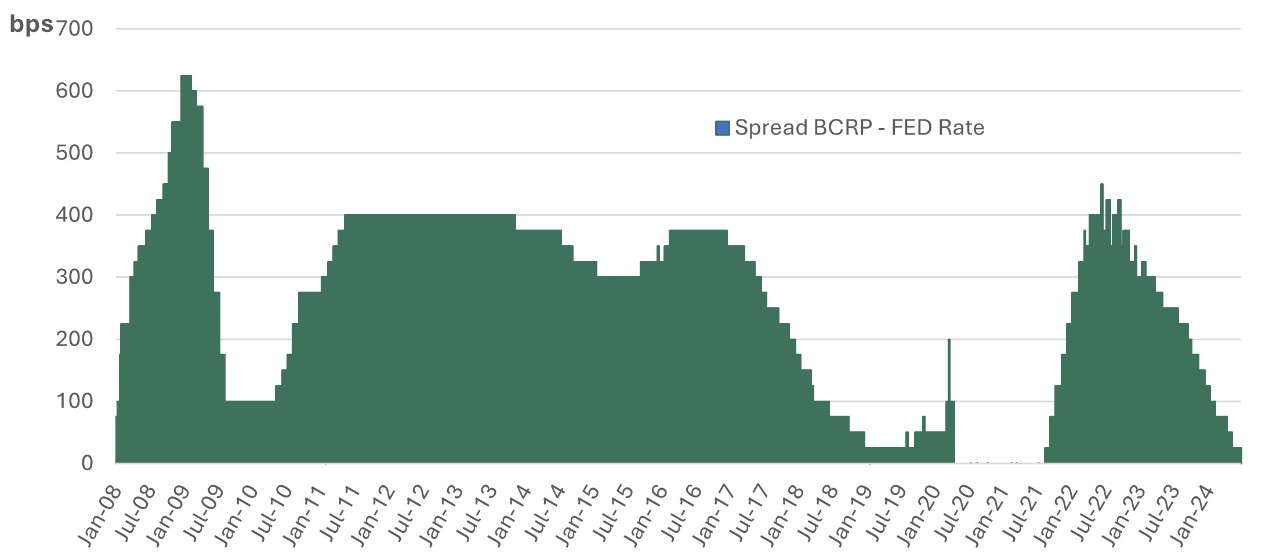

Currently, the spread between the Fed’s reference rate and the BCRP’s reference rate in soles is 0.25%, compared to a historical average of around 2.50% for the period of 2008-2024.5 The current level of the differential reflects the current context of divergent monetary policy between the two countries.

Source : Federal Reserve Bank of St-Louis, FRED and Banco Central de Reserva del Peru, BCRP.

Implications for the Central Reserve Bank of Peru – BCRP

The rebalancing of capital flows out of Peru due to the adjusted differential between both interest rates can generate depreciating pressures on the Peruvian sol. The central bank is aware that currency depreciation ultimately leads to inflationary pressures, which complicates its task of keeping rates low to stimulate the economy. It is important to highlight that the main objective of the Peruvian Central Bank is to maintain monetary stability through an explicit inflation targeting framework, with an annual inflation target between 1% and 3%.

In this scenario, the Central Bank of Peru (BCRP) proactively uses various mechanisms to intervene in the foreign exchange market and prevent local currency depreciation that could lead to inflationary pressures. The Central Bank employs multiple monetary policy instruments to manage liquidity levels and reduce exchange rate volatility, both crucial for maintaining stable inflation. The control of inflation and the transparency of the central bank have helped restore confidence in the Peruvian sol and investments in local currency bonds.6

One mechanism that has allowed the Central Bank of Peru to maintain a stable monetary policy resilient to external shocks has been the accumulation of Net International Reserves (NIR). These reserves strengthen the Central Bank’s position to address liquidity shocks caused by turbulence in global financial markets that lead to sudden capital outflows.7

Multiple studies on this topic demonstrate that the BCRP’s management underscores the importance of a flexible monetary policy framework that incorporates unconventional tools to manage global contagion effects. The BCRP’s proactive use of reserve requirements and interventions in the exchange market has been crucial in maintaining economic stability amid global financial volatility.8

In summary, monetary policy in Peru, while not entirely immune to the Federal Reserve’s policy, is relatively less dependent compared to other countries in the region. In other words, sovereign bond rates have more independence from U.S. Treasury rates than other emerging markets. This is due to responsible monetary policy that has allowed the BCRP to accumulate high levels of international reserves, currently amounting to $74 billion, equivalent to 28% of GDP.9 This percentage for countries like Brazil, Chile, and Colombia ranges between 12% and 14%.10

The BCRP has demonstrated a remarkable ability to effectively manage monetary policy and mitigate the impact of U.S. rate movements on the local economy. In fact, according to recent statements by Central Bank President Julio Velarde, the reference rate could be set below the Fed’s reference rate. He also recalled that in 2011, the BCRP set its reference rate 100 basis points below the Fed’s rate.11

This has clear implications for global macro investors, as the low correlation between sol rates and U.S. Treasury rates allows investments in Peruvian sovereign bonds to maximize diversification benefits. An analysis of the correlation of 10-year government bonds in local currencies with U.S. Treasury bonds from 2019 to 2024 shows that Peru has one of the lowest correlations (18.69%), followed by Brazil (24.39%), Colombia (35.88%), and Mexico (46.32%).12

Finally, the impact on corporations with global operations and exposure to soles is also significant, as the stability of the monetary policy instills confidence in local assets, both in the Peruvian sol and in local interest rates, thereby providing greater predictability for adequate financial planning.

For more information, please contact:

Debora Martin

Associate Director, Emerging Markets Trading

Phone: 212-225-6541